The tech-heavy Nasdaq led losses on Wall Street amid growing fear that the United States Federal Reserve will raise interest rates.

By and Bloomberg

Published On 13 Jan 2022

Technology companies led stock losses amid widespread calls from Federal Reserve officials to raise rates to prevent inflation from taking root in the U.S. economy.

Traders also assessed news that a divided Supreme Court blocked the centerpiece of President Joe Biden’s push to get more people vaccinated, rejecting a rule that would have required 80 million workers to get shots or periodic tests. The Nasdaq 100 sank more than 2.5%, led by losses in Microsoft Corp. and Tesla Inc. Chipmakers erased gains that were earlier driven by Taiwan Semiconductor Manufacturing Co.’s growth projections. Boeing Co. rallied as Bloomberg News reported the 737 Max is set to resume commercial flights in China as soon as this month.

Fed Governor Lael Brainard said officials could boost rates as early as March to ensure that generation-high price pressures are brought under control. Fed Bank of Philadelphia President Patrick Harker favors a March liftoff and three or four hikes for 2022. His Chicago counterpart Charles Evans — who sees a similar number of increases this year — said he couldn’t judge the likelihood of the first raise taking place in two months’ time. Richmond Fed President Thomas Barkin said officials will be in a position to start normalizing rates at their March meeting should circumstances support that.

“We are in a position where much that has been positive for equities is maybe moving to neutral or negative, and while there are still few alternatives, it makes the equity market ripe for more fluctuations over the next few months as we see how the data shake out and how the Fed reacts,” said Sarah Hunt, portfolio manager at Alpine Woods Capital Investors.

Rising rates — an upshot of strong economic growth — could drive investors toward value stocks, which tend to be more cyclical and offer near-term cash flows. That leaves growth shares wanting for buyers. The long-term earnings potential of the relatively expensive technology companies could become less appealing amid elevated inflation.

“Tech is the classic example of an area where stocks have really benefited from the decline in rates,” said Kara Murphy, chief investment officer of Kestra Investment Management. “As expectations rise for rates going forward, then it makes sense that would be the area that would get hurt more.”

Prices paid to U.S. producers decelerated in December as two key drivers of inflation in 2021 — food and energy — declined from a month earlier, representing a respite in the recent trend of sizable increases. At the same time, producers continued to face a variety of materials shortages, limited labor supply and transportation bottlenecks that sent prices soaring last year.

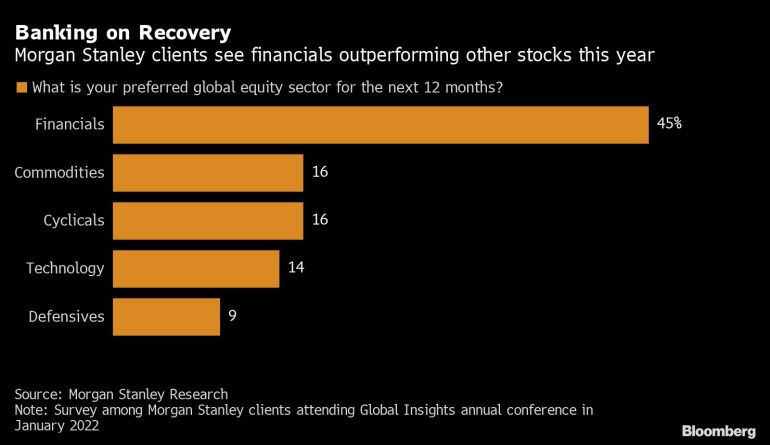

Morgan Stanley clients expect financial stocks to outperform this year, according to a survey at its annual conference this week. The poll shows that 45% of respondents bet the industry will be the best performer in 2022. That’s the highest share of the votes for the sector since 2015, the firm said in a note Thursday.

Here are some key events this week:

- Bank of Korea policy decision and briefing on Friday.

- Wells Fargo, Citigroup, JPMorgan due to report earnings on Friday.

- U.S. business inventories, industrial production, University of Michigan consumer sentiment, retail sales on Friday.

- New York Fed President John Williams speaks Friday.

For more market analysis, read our MLIV blog.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 1.4% as of 4 p.m. New York time

- The Nasdaq 100 fell 2.6%

- The Dow Jones Industrial Average fell 0.5%

- The MSCI World index fell 1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1452

- The British pound was little changed at $1.3705

- The Japanese yen rose 0.4% to 114.14 per dollar

Bonds

- The yield on 10-year Treasuries declined four basis points to 1.70%

- Germany’s 10-year yield declined three basis points to -0.09%

- Britain’s 10-year yield declined three basis points to 1.11%

Commodities

- West Texas Intermediate crude fell 1.4% to $81.46 a barrel

- Gold futures fell 0.3% to $1,821.20 an ounce

Top Naija News: Nigerian News, Breaking News Nigeria and World News Top Naija News is a daily news publication in Nigeria, delivering the latest breaking news in Nigeria and around the world.

Top Naija News: Nigerian News, Breaking News Nigeria and World News Top Naija News is a daily news publication in Nigeria, delivering the latest breaking news in Nigeria and around the world.